4 Meta's Perceived-Value Pricing Model

Pricing Method Meta uses the standard pricing method for online ads, the Cost per

Thousand Impressions or CPM (impressions are full ads shown on a page)

Product Offering Meta has developed a distinct product for each of the 4 stages of what

we can call the customer's own value chain:

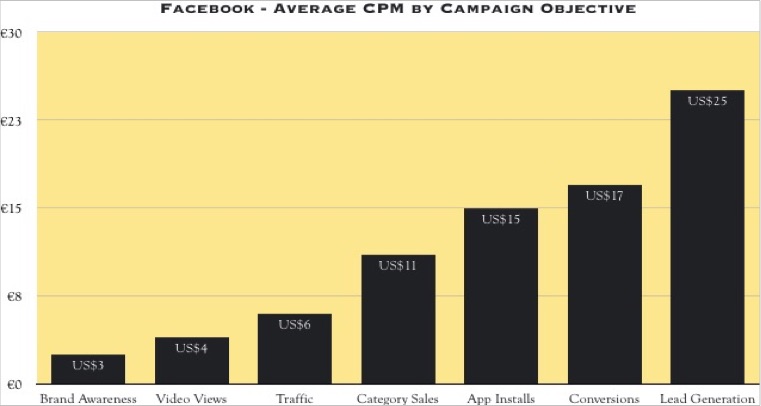

. Stage 1 - Advertising This first stage covers the entire ad campaign process, from content

development to ad placement. On the graph, on the first bar, Brand Awareness, we wee

a CPM of $3 per thousand impressions

. Stage 2 - Analytics This second stage involves the data collection and analysis on the

customer's customers's buying habits based on their demographic profile. On the graph,

the 2nd and 3rd bars, Video Views and Traffic, we see CPMs respectively of $4 and $6

. Stage 3 - Engagement This third stage concerns the clicks the customer's customers make

to open up the ad or access the customer's website. The customer immediately engages

by making contact, online and/or physically, with his prospects. On the graph, it is

not clearly shown, since it cust across the analytics and as describe below, the sales

conversion stages

. Stage 4 - Sales Conversion This last stage is the most important, when the customer's

customers finally make the decision to buy the product. On the graph, on the last 4 bars,

Category Sales, App Installs, Conversions, Lead Generation, we see much higher CPMs,

respectively of $11, $15, $17, and $25, reflecting the higher prices Meta charges reflecting

what customers are willing to pay for products they perceive to be of higher value

Perceived-Value Pricing Kotler calls the type of pricing Meta applies, perceived-value

pricing, where prices are scaled up based on a customer's perceived value. On the graph,

we clearly see that the highest generic value is given when a sale is made, at the final

sales conversion stage

3 Meta's Market Opportunities

If we use Ansoff's product-market expansion grid, we can say that Meta is pursuing,

through the Metaverse, a typical "new product-current market" strategy, by offering its

new products to the 5 current markets, which are its core Social Media and 4

well-established markets it wants to enter, namely the Consumer, Business, Gaming, and

Fintech markets. As listed below, of these 5 generic markets, there's a total of 6 target

markets, 5 of which are entirely new busineses with new economic and revenue models

Meta must put in place and operate:

Meta's 5 Businesses As the table below shows, Meta will have 5 businesses serving

its core Social Media market as well as the Consumer, Business, Gaming NFT

and Fintech markets

Meta's 6 Target Markets The 6 markets Meta is targeting are the following:

. the Social Media market which will continue to be its core business and cash cow.

In the near future, we believe Meta will most likely operate 2 social media platforms

On the one hand, what it calls its "family of apps", namely Facebook, FB Messenger,

Whatsapp, Instagram, will serve a mature market, comprised of users who do not want

to change their habits. With their total customer base of 3.9B MAU users, ad revenue

totaling $117B in 2021, and still room to grow, these platforms will continue to be

nurtured

On the other hand, with its Metaverse Horizon platforms, it is targeting what will be

the most important demographic group over the next 10 years, the Millenials and the

Gen Zs. The key innovation Meta brings is to provide this younger and more digitally

literate group of users with the type of easy-to-use no-code/low code tools to help them

create their own platforms, either as their own social media platforms, or as we saw

earlier with Wendy's, as their own business platforms. There were some 10 000 such

platforms, which it calls "worlds", which have been created since Horizon Worlds was

launched in September 2021.

To the above horizontal approach, Meta has created a number of vertical platforms

to serve the following target markets it wants to enter:

. the Business market, now dominated by Microsoft and Slack. Meta's products are Meta

Workplace and Horizon Workrooms for the Office market, Meta Portal for the Video

and Meta Novi for the Digital Payment market, Horizon Home for the remote work market.

There is also the need to be backward integrated with a Cloud Infrastructure platform, to

compete against Amazaon's AWS, Microsoft's Azure, and Google's Cloud Platform

Part of the broader Consumer Market:

. the Retail market, where physical and online stores seamlessly interact. It is dominated by

Amazon, Walmart, Apple, Shopify, and the major retail chains. Meta's products are Horizon

Venues and Horizon Worlds which is both a socal and ecommerce platform (Wendy's joined)

. the Smart Home and Smart TV market, through its Meta Portal app and platform, to go

against Disney, Netflix and the powerful MSO's such as Comcast and AT&T

. the Gaming NFT market, through its Horizon Worlds platforms and Oculus 3D AR/VR

headset, to go against Microsoft's Acitivision Blizzard online games and Xbox consoles

. the Fintech market, through its Meta Novi product, as an alternative to Apple Pay and Google Pay

Meta's 4 Revenue Models Firstly, Meta will most likely extend its formidable ad tracking

engine, which in fact tracks users' searches, to help it sell its new Metaverse products, by

adding search features adapted to each of its new platforms, such as a product search

engine on its eCommerce platform, Horizon Venues. Secondly, it will put in place new

dynamic pricing, billing and payment systems, based on the following revenue models:

. the advertising revenue model for its existing family of apps, catered to its core

consumer social media market, from which it generated $117B of revenue in 2021

. the transactional revenue model for its eCommerce platform, catered to the

consumer market, which is dominated by Amazon

. the subscription revenue model for its new products and platforms, catered to the

business market

. a hybrid transactional and subscription revenue model for its Horizon Worlds gaming

platform, in which it will fit its NFT offering, as well as for its Smart home and Smart

TV market

1 The New OmniChannel - Metaverse vs NFT

After eCommerce with Amazon, search with Google, social media with Facebook, video

sharing with Google's YouTube, video streaming with Netflix, and Cloud data centers

with Rackspace, all of which are standalone marketing channels, we are witnessing the

emergence of what could be the first truly interconnected Internet omnichannel,

The Metaverse, engaging, as first movers, an incumbent, Meta, and a challenger, the NFTs

Monetization However, bottom line, the Metaverse is another one of those monetization opportunities which have brought riches to the IT industry over the last 60 years. There

was IBM's leasing of its mainframe computers, followed by Microsoft's and Apple's

licensing of software that was previously given out for free, then the Cloud's annual

subscription payment for apps we previously bought comparatively much cheaper once

every 5 years

The New Product With computer hardware, software, and services thus fully monetized

and guaranteeing a greater, more steady and recurring stream of revenue ($5T to $6T

per annum), in the Metaverse, the IT industry is once more on the war path, this time

to monetize what has only been very partially monetized, digital media content, or what

is now known as digital assets

The New Product Market So-called commercial audiovisual companies selling on the

Web digital assets, that is, digital images and videos, have been around for some time.

Probably the biggest among them, Getty Images, already generates some $800M a year of

revenue and is estimated to be worth $5B. Yet, the addressable market for digital assets

can now be much further expanded many times over, by developing entirely new

products and platforms, made possible by a spate of relatively new Internet, Web, and

Cloud technologies introduced over the last few years

The New Technologies Before Meta, the first Metaverse companies, the NFTs, beginning

with Roblox, realized as far back as the mid-2000s that their mastery of the recently

introduced and more powerful Internet network (4G then 5G), Cloud data centers, and

user-friendly programming tools would enable them to develop a more complete market

offering (see Technologies page)

The New Product Market Channel Somehow overlooked by the incumbents, the NFTs

developed an integrated platform that could not only distribute and sell digital assets

downstream but also provide upstream the self-service no code tools for users to create

their own original digital assets. The NFTs were able to get ample financing from VC

and PE funds to scale up their full-service platforms

The NFTs' Marketing Plan The NFTs applied the marketing mix's 4Ps as follows:

Price Their insight was that if they could package and label digital objects as works of

art, giving customers the impression that they are worth much more than what they're

really worth, they could charge a much higher price. Finding a way to guarantee the

"authenticity" of these works of art was therefore absolutely key. They did not need to

look very far to find it, since the cryptography technology powering their own platforms,

blockchain, was ideally suited to generate and assign a highly secure digital signature,

the NFT token, to each digital object they carried

Product So that users can make the most original digital objects, they put at their

disposal the learning and tool kits, which have been extensively used by the online

gaming industry and movie studios to make their 3D animated cartoons and 2D/3D

AR/VR digital objects. One such digital object, an extreme case, was a collage of 5000

jpeg images put together by the artist Beeple, which sold for $69M at a Christie's

auction

Place The smaller NFT platforms operate either as developer platforms where users can

create their digital objects, or as buy-and-sell marketplaces . The bigger, more established

platforms, like OpenSea, operate both

Promotion One is always in awe of how the NFTs have so effectively advertised on the

Web, receiving billions of hits on Google Search alone. Likewise for Meta's media blitz

Even if the NFTs will fix their offering's few remaining flaws (the price volatility of the

currency of payment, cryptocurrencies, cybersecurity issues related to the on-site file storage

of both cryptocurrencies and digital objects, getting the marketing plan right with the 4 Ps

is only a first step. The next step is to develop a competitive strategy, using Porter's 5-Forces

model. This is where Meta, owing to the overwhelming resources they can bring to bear to

overtake the market with a similar product substitute, may have a head start over the NFTs

5 Meta's Cash Position

A quick reading of Meta's SEC 10-K filing for 2021 shows in fact that it is still a very healthy

company, able to sustainably generate enough cash to finance its strategic realignment:

Cash Meta's 2021 free cash flow reached nearly $40B. Its cash in hand including marketable

securities was at $48B. Most importantly, had it not spent $45B to buy back its stock, its

cash position would have totaled a whopping $93B. In short, it has more than enough

cash to finance its Metaverse project, in which it expects to invest nearly $40B in 2022

Cash Cow Meta's cash cow, its "Family of Apps" business, comprised of Facebook,

Messenger, Whatsapp and Instagram, still accounts for 98% of total revenue of $118B

with the remaining 2% coming from its "Reality Labs" AR/VR Oculus headset business.

Meta's ad revenue drivers are its 3.9B monthly average users (MAUs), daily average users

(DAUs), and the DAU/MAU ratio, or more precisely the communities to which they

belong and the amount of commerce they engage in online. The bigger the size of these

communities and the more they shop, the more advertising Meta can sell. This is what

happened in 2021, when Meta's revenue per user, the ARPU, increased by 50% compared

to that of March 2020 during the lockdown. We think that what Meta is aiming to achieve

with the Metaverse is to directly sell and advertise more on these communities and

commerce platforms, by transformingwhat is its franchise, its social media platform, into

a Metaverse platform

6 Meta's Financial Performance - Applying EVA

Reporting Constraints Meta's consolidated Q1 2022 P&L shows a 38% increase in

operating expenses compared to the previous year, from $9.7B in Q1 2021 to $13.4B

in Q2 2022, while revenue increased 7%. This resulted in a decrease in Meta's

operating margin to 31%, from 38% the year before, already skewed by an increase

in Metaverse spending. Its historical operating margin, as a rule of thumb, has

always been in the 50%, that is, before it started to overspend to develop its Metaverse

project beginning in 2021

However, if we deduct those expenses which are linked to the Metaverse, we should

come to its traditional operating margin of 50% or $14B instead of the $8.5B it was

forced to report to the SEC, in compliance with GAAP standards

As proposed by EVA (Economic Value Added), those operating expenses linked to

the Metaverse, should be capitalized over multiple years, the same way we capitalize

fixed assets, whose life exceeds a year. Based on this measurement, Meta wins

hands down

All told, by its willingness to sacrifice short-term paper results for real long-term

gains, Meta is pursing the right strategy

Capital Markets Behavior What's ironic is that in spite of this unfavorable reporting

of its operating expenses, its stock price shot up by 20% after the Q1 2022 earnings

release, after plunging by 50% on the heels of the full year 2021 earnings release,

which reported a 37% increase in both revenue and operating margin. It was the

massive sell-off, possibly by small investors, which is behind the price drop

Market Behavior What the 10-K SEC report also shows is an increase in the number

of users in the Asia-Pacific region, whose penetration rate is 63% compared to the 73%

of the more mature NA region. The only performance metric that counts is not the

increase in the number of users (in MAUs, DAUs variants) for all of Meta's regional

markets, but for that market where the penetration rate is still low, that is, in the Apac

region

Case Study

Customer Engagement & Sales Conversion

(higher CPM)

2 Meta's CompetitiveThreats

Meta's Competitive Advantage The underlying Open Source technologies (blockchain, 3D

AR/VR, Unix, Java,...) being the same and freely accessible, where the big predators,

beginning with Meta, have a competitive advantage over their smaller NFT rivals is in

both the money and customer base they have:

. their cash holdings in the tens of billions of dollars, generated by their cash cows, can

be spent to jumpstart product development and to wage a protracted marketing

campaign to wear out their smaller NFT competitors

. their customer base of billions of users are always receptive to try out the type of high

quality products they are accustomed to getting from them

Meta's New Product Lineup Each Metaverse platform Meta has created, under the Horizon

brand, could compete directly against the major Internet companies: Horizon Venues

against Amazon in eCommerce, Horizon Workrooms against Microsoft's MS Office and

Dynamics platforms, and Horizon Worlds in gaming, where NFTs will first be offered

Meta's Current Competitor There are 2 distinct products, which have been developed to

serve this new channel: NFT Blockchain platforms and Meta's Metaverse platforms.

Although both are essentially powered by the same underlying Internet, Web and Cloud technologies as we will see throughout this page, both platforms have developed distinct

market offerings, in order to serve their respective target markets. See point 3 below for

a complete description of Meta's target markets

Meta's Future Competitors It will not be long before the major Internet companies will

come up with their own Metaverse offerings, which they will adapt to their respective

businesses

For example, Microsoft has added what it calls a Metaverse layer to its Office 365 with

Mesh and Dynamics 365 with Connected Space. It has acquired Activision Blizzard for $69B

to position itself in the biggest Metaverse market, the online gaming market. There

is also Elon Musk's buyout offer of Twitter for $43B to enter the Metaverse market

Even if Meta has developed its Metaverse products, it still needs to develop the businesses,

still relatively new to them, around its Horizon Venues platform to compete against

Amazon's $468B eCommerce business, around its Horizon Workrooms platform to

take on Microsoft's $168B Enterprise business, around its Horizon Worlds platform to

go against the entire MMORPG gaming industry, around its Smart Home Meta Portal

platform to go against the Smart Home/Smart TV industry

Meta will go after that part of the market which has not yet been tapped, but so will these

companies

Advertising & Analytics

(lower CPM)

Social Media Market

(market Leader)

SOCIAL MEDIA

Facebook, Instagram, Messenger,

Elements Of Meta's Business Strategy

Consumer Market

(market Challenger)

RETAIL

Horizon Venues*, Horizon Worlds*

SMART HOME & TV

Meta Portal***

Business Market

(market Challenger)

BUSINESS

Meta Workplace**

Horizon Workroom*

Horizon Home (remote work)

5 Generic Markets, 6 Target Markets, 7 New Products, 4 Existing Products

Fintech Market (market challenger) Meta Novi**

Gaming NFT Market (market challenger) Horizon Worlds*

All Horizon Platforms

Millenials (Gen Ys), Gen Zs

Baby Boomers, Gen Xs

Targeted Demographic Groups:

* oculus.com (combined VR headset and Horizon apps)

** workplace.com, novi.com,

*** portal.facebook.com

Or Man Partners