Our Strategic Review of Apple, using the 4 Ps, addresses the fundamentals in 16 questions, as follows:

Applying The Fundamentals

. What is your idea: the insight, the business opportunity and the marketing strategy (1)

. Do you have the right resources: the partnerships, the financing, and the management team (2-4)

Using Your Strengths

. Do you have the right strategy: the strategy (5-8), the excellence 5 Forces (9-12), the business model 4 Ps (13-16)

. Do you have the right controls and processes: part of a separate review of your financial controls and business processes

5 The Product

Strengths Apple has always stuck to what it does best. It has always been first and foremost a

device maker. Its strength has always been in its unique ability to combine technical prowess and beautiful design, the iPod, developed in barely 9 months, being a prime example. Even the launch

in 2001 of both an online channel, the iTunes Store (9 months before the iPod was launched) and

a retail channel, the Apple Stores, were primarily aimed at selling more of its Mac PCs. With the back to back launch in 2007 and 2008 of the iPhone and the App Store, Apple still maintained a

first-mover advantage, simply because it was the only one among its peers to offer what its

customers wanted, that is not only a mobile device to play their music and run their apps on but

also a channel to download them. Marketing Approach In other words, Apple took a "market-centered" rather than a "product-centered" approach to product development whereby

the market's needs define the products rather than the other way around. Market Dynamics

Upstaged by more innovative upstarts in services (YouTube in video sharing, Spotify in

music streaming, Netflix in video streaming, Game streaming), Apple leveraged its overwhelming strength as an online distributor to help them sell their streaming apps on its online stores.

Customer Retention Its safety net is its base of 1.5 billion customers,whom it cannot afford to deceive

iPhone At the outset, Apple knew that it could make a high-end multi-purpose smartphone which would combine a music streaming player with the iPod, a miniaturized PC with a Wifi or 4G connection and Unix operating system, and a wireless mobile phone. To command premium pricing, it would add value that would be perceived as substantial by the customer by upgrading the iPhone with the latest technologies. The upgrades would be introduced at breakneck speed, every year. Its iOS 14 iOS is in its 14th version and its 2021 iPhone 13 model runs on an 15B transistor chip that has 15 times the transistor count of the A7 chip launched in 2013

Macs and iPads To counter the rise of 2-in-1 foldable Windows notebooks, a year after the rollout of its M1 Macbooks, Apple introduced in September and October 2021 another impressive lineup of new iPads and of Macs equipped with new M1 Pro and M1 Pro Max 37B transistor chips

Wearables, Home, Accessories The explosive growth of a revamped Apple Watch and Airpods in 2019 will persist until 2022. The Apple Watch is expected to increase from 75 million units sold today to 115 million by 2022. The Airpods are forecasted to increase from 33 million units sold to 158 million. In 2019, Wearable sales doubled to $25B in 2019 from its 2017 level

Services Apple continues to generate most of its sales revenue in services from the App Store. Most of its App Store revenue come from the additional purchases consumers make within the app they buy or download for free, hence their name, "in-app purchases". The recent court ruling in

favor of Epic, the game developer, will force Apple to give consumers the option to go to

competing online stores (Google Play,...) to make those in-app purchases, on which the App Store previously had exclusitivity. This could translate in a worst case scenario into a potential loss of

$3B to $4B of commission revenue on the game apps alone. To preempt this, Apple has brought down its commission rate by half to 15% on the most exposed apps. It has also heavily invested

to develop its video streaming offering, less as a content provider (its new media bundle is a

mixed success), than as a content distributor leveraging its free app, the Apple TV to sell both 3rd-party subscriptions and...its own paid in-app, the Apple TV+

Internet of Things In April 2021, Apple launched its FMCA (Find My Certification Assistant)

app, to open up its Find My network technology to 3rd-Party companies. The app allows them

to create accessories that communicate with Apple devices, using its MFi technology

9 The Core Excellence

Apple's core excellence is its developer platform. It is in fact three platforms in one: the software engineering platform, the hardware engineering platform, and integrating both together, the

user interface platform

The Software Engineering Platform

At the time of its inception, to attract the most talented developers, Apple's developer platform

had to fulfill 3 requirements as well as provide all of the software tools they would need

The Requirements:

1st Requirement It had to be easy to use. Just as it chose Unix for its simplicity to develop its

computers' operating system, the MacOS, Apple did likewise for its developer platform. It relies

on merely 2 programming languages and 2 repositories of tools, also known as "frameworks", to

help developers develop their customers' end-user applications. The 2 languages are Objective-C

and its more simplified version Swift. The 2 frameworks are Cocoa originally conceived for its

PCs and Cocoa Touch for its mobile devices, beginning with the iPhone

2nd Requirement It had to be "cross-platform" so that developers adept at other programming

languages, whether it is Java, Python, Ruby, etc,..., could also use it. Apple's platform is connected

to all of the frameworks which are most commonly used by developers

3rd Requirement It had to provide an outlet for developers to sell their apps. The creation of

the App Store in 2008 is such an outlet. Since its founding, it has generated $100B of gross

revenue

The Software Tools

Coding Tools Its Swift web application framework is connected to 12 other frameworks

and its Objective-C framework is connected to 7 other frameworks

Testing Tools Its framework to test software, TeamCity, is connected to 10 other frameworks. Its

software version control and release framework, Xcode, is connected to 8 other frameworks. Its

software performance control framework, Pingdom, is connected to 40 other frameworks

Application Development Tools It is through the Sentry error detection framework that

Apple's developer platform is connected to the much broader developer network. The following

is a sample of some 70 frameworks it is connected to: languages (Java/Javascript, Python, PhP,

Ruby on Rails), operating systems (Matcha, LambdaNative), interactive applications (node.js,

angularJS), AI applications (Nanonets, Swift AI), cloud applications (Apache OpenWhisk),

web applications (Vapor, AnyChart), user interface applications (Material, Render),

AR/VR/3D applications (Amazon Sumerian)

The Hardware Engineering Platform (2007 vs 2020)

Apple rightly chose to focus on only a few technologies, in fact 3, that would allow it to maintain its

wide lead over its rivals. These 3 technologies are i) optical technologies behind its AI facial recognition TrueDepth camera, ii) SoC chipset technologies with a chipcount on the iPhone that increased from 1B in 2013 to 11.5B transistors in 2020, iii) network technologies as it readies for the shift to 5G

Optical Technologies The first iPhone, launched in 2007 had a single-lense 2 megapixel camera.

This year's iPhone 12 Pro has 3 12 Mega Pixels Film Studio quality cameras equipped with ultra wide, wide and telephoto lens of f/2.4, f/1.6 and f/2.2 apertures, run on a neural engine chip capable of making 5000 adjustments per second and of capturing low light vision. As shown below, the telephoto camera, used for portraits, equipped with Apple's proprietary TrueDepth camera system and Face ID AI facial recognition software, is able to capture

30 000 invisible dots to create a depth map of your face. The LiDAR Scanner on the 2020 iPhone Pro and iPad Pro run the latest Augmented Reality (AR) applications used to map "room-scale" objects as far as 5 meters away

Processing Chip The CPU chip which equipped the first iPhone in 2007 had a clockspeed of 412 Mhz, 32-bit processor and was 90 nm in size. End 2020, its A14 Bionic chip on its iPhone 12 and iPads had a clockspeed of 3100 Mhz, 64-bit processor, was 5nm in size and accomodated both a CPU and a GPU. Other than the increase in the number of transistors (from 1B on the A4 to 11.5B on the A14) and of transistor nodes ("gates") using extreme ultra violet (EUV) lithophotography nanotechnology machines to engrave them on a silicon die of 88 square millimeters, the main innovation of the last 3 years has been in the use i) of programmable chips (FGPA and ASIC), ii) of machine learning accelerator chips (Apple's "AMX blocks") added onto the CPU and GPU chips, iii) of an AI neural engine to properly allocate workloads to the best suited chip to achieve speed and lowest power consumption. All of Apple's software on its devices, system and user, now include AI algorithms

Network Technologies As part of its strategy to design in-house key critical technologies, Apple acquired Dialog's power management chip business end 2018. Regarding the highly strategic 5G wireless modem, Apple first bought out, in 7/2019, Intel's 5G modem business, taking ownership of key patents and bringing in 2200 engineers. Then, in 12/2019, it struck a 6-year agreement with Qualcomm to co-develop a 5G modem, combining Intel's and Qualcomm's Snapdragon technologies. Beg 2021, Apple began recruitment of telecom engineers to develop 6G

The User Interface Platform (2007 vs 2020)

With the iPhone's two signature user interfaces, the touch screen and its natural language (NLP) voice assistant Siri, Apple has shown its unrivaled mastery of the entire technology innovation process, in product development and in business development. With the touch screen, which was invented in the late 60s, its innovation insight was i) to develop the product, the iPhone and its iOS operating software to accomodate the touch screen instead of the other way around, then ii) to develop the product's business, by finding the leading channel partner, AT&T, to distribute it at scale. It recently did the same with 2 other technology inventions from the 70s, natural language voice recognition with Siri and facial recognition with TrueDepth

2 The Partnerships

Channel Partnerships In the span of a few years in the early 80s, in spite of having a (slightly) superior product in its Apple II PC to the IBM PC, Apple lost out to IBM, at a time when the PC market was growing at 40% a year. It made the 3 following mistakes. Product Cost: the first mistake Apple made was to starve the very popular Apple II and sell instead a succession of new products (Apple III, Lisa, Macintosh), which, tho' innovative, turned out to be so costly they had to be priced at 5 times the acceptable market price. Product Partnership: it also refused to partner with the leading software publishers (Adobe). Channel Partnership: this forced its channel partners to turn to IBM's reasonably priced IBM PC. This time around, in 2004, a major distributor, Cingular (later acquired by AT&T), impressed by the success of the iPod, came knocking to ask Apple to make what was to become the iPhone. A more mature Jobs more carefully listened before accepting and by doing so, had clinched access to AT&T's very large subscriber base of some 100M mobile phone users, in both the business and consumer markets, making them potential buyers of the iPhone. 2020 Sales: Direct Channel 31%, Indirect Channel 69%

Technology Partnerships Unbelievable as this may sound, Apple, a PC maker, did not know how to make mobilephones. This explains why, at AT&T's prodding, it accepted to team up with Motorola to make a cellphone, the Rokr pictured below, with an iPod built in. Forged too hastily, the alliance with Motorola broke up shortly thereafter, not without Apple acquiring in the meantime the know-how to design and manufacture a mobilephone, integrating its capabilities into its iPhone. Porter was right: doing better is not enough, doing differently is the key to success

Industry Partnerships Apple chose to defer to the best industry standards to achieve a level

playing field in both performance and cost for its products. It was only by building on this very

solid base, that it was able to develop its differentiation strategy with a distinct market offering

at the higher-end of the market, leveraging its uncommon excellence in product development.

Fast forward to 2021, we see today that Apple relies on a number of industry breakthroughs in

AI of the last 10 to 15 years to develop its AI speech recognition app Siri and its AI facial

recognition app True Depth and integrate them into the iPhone

1 The Insight

The insight came from the first iPod, launched in 2001. It was the successful miniaturization

of the music player's two key electronic components normally found in computers, the 1.8 inch hard

drive and the logic board containing 2 chips (CPU and Audio), which convinced Apple that it could

pack not just 2 but all of of a computer's components into a palm-sized device. On this insight,

Apple went on to make the iPhone, introducing it in 2007. A teardown of the first generation

iPhone will show that it contained at least 6 chips soldered on the logic board: a wireless network (1), CPU (2), GPU (3), audio (4), touch sensor (5) and display (6) chip. With exceptional foresight, Apple

also made sure that the iPhone's operating system would carry all communication protocols and media formats, which were in the process of becoming fully digitized. The iPhone's differentiated feature was that it would be an "app-based" hand-held device, the phone being just one of the apps. "Monetization" would come as much from the sale of the phone as from the sale of apps

To turn that insight into a viable business opportunity, Apple had to develop its marketing strategy.

This entailed i) finding the right product/market/channel fit to best serve the largest possible

number of customers, ii) building a customer-focused organization, iii) securing the financing to provide the staying power to execute the action plan. Apple was lucky not only to have in its highly profitable iTunes and iPod products the cash cow for the financing but also to have in both

products' large customer base a readily receptive market for the iPhone. In AT&T, the largest

wireless distributor in the US, it found the ideal channel partner. Often times, a competitive

advantage is achieved by taking advantage of your competitors' mistakes

Success: Do differently

(the 1st iPhone, released in 2007)

The touchscreen was an essential design feature which Steve Jobs believed would further strengthen Apple's competitive advantage over Blackberry.

It was intially meant to equip a tablet, what was to become the iPad, which Jobs was also developing.

Watch above Jobs' keynote introducingg the iPhone in 2007

Failure: Do better

(the Motorola Rokr, released in 2005)

The iTunes app and the iPod hardware were a bit too hastily added to a Motorola mobilephone

7 The Strategy

Firmly positioned at the higher-end, Apple's business strategy is to be the market leader, rather

than the market follower, across all stages of the value chain:

Channel Leadership Build up an integrated distribution channel which could seamlessly

cross-sell between its online and offline stores. The first Apple store was opened in 2001, the

iTunes store also in 2001 and the online App store in 2008. The computer programs of both

online websites, or platforms as they are now called, were written in off the shelf Open Source

application and web programming languages

Product and Brand Leadership Equip all products with a Unix-based operating system and a Risc-based CPU chip. Both the OS's and the chip's software were also coded in Open source languages. All of Apple's products were to be designed for ease-of-use, exceptional aesthetics and

to contain the latest breakthrough technologies (i.e. its AI apps in facial recognition Face ID

and in speech recognition Siri, and in 2020, the latest AR/VR and 5G technologies)

Market Leadership Position the iPhone at the higher-end but price it at the lower-end to

penetrate the market. It took Apple 6 years to acquire a large enough base of new customers, to

whom it would sell cumulatively some 300 million iPhone handsets between 2007 and 2013. It

took another 6 years for Apple to turn its new customers into loyal customers, creating its own replacement market

Industry Leadership Design in-house the products to guarantee the highest quality its

demanding customers expect but subcontract production to keep costs low. Innovate at

breakneck speed to reduce the product lifecycle to a year, so that competitors would not be

able to follow

Digital Leadership Apple's Cloud platforms are designed to give visitors a unique interactive

digital experience. They are what is now commonly known as digital experience platforms or DXP

4 The Management Team

The CEO Steve Jobs became a much more mature and well-rounded businessman by the time he

returned to Apple in 1997, considerably expanding his skills in product development to marketing

and distribution, honed at Pixar, his previous firm (it didn't hurt either to have a wife who had a

perfect business pedigree). A proof of this change was the decision he took to open up the Mac PCs

and later on iTunes to Windows and Intel chips to potentially reach out to the hundreds of millions

of non-customers he stubbornly shunned 12 years before during his first stint at Apple. He

also became a much better manager of people, surrounding himself with a very diverse group of

young and talented functional executives, without whom Apple's complete transformation from

PC maker to the digital company it is today may perhaps never have materialized.

The Management Team Steve Jobs built up a formidable management team, not only on the

technical side but also on the business side, in 6 key areas. The sales function was substantially

strengthened under Jobs's de facto COO, Tim Cook, who oversaw education sales, channel sales,

iPhone sales, and the online stores, all of which represented one and the same market offering.

The operations and fulfillment function was headed by a young Jeff Williams. The marketing

function was under the responsability of Phil Schiller. The Internet services business (the iTunes

and App store) was put under Eddy Cue. The Apple Store was run by Ron Johnson. The finance

function was managed by Peter Oppenheimer. With the exception of Oppenheimer and

Johnson, the remaining business function heads are part of Apple's current leadership team,

nearly 20 years running, reflecting a remarkable stability and cohesion

The All Important Sales Function By early 2014, Apple once more broke away ahead of its competitors by introducing a new iPhone model equipped with a 2 billion transistor-strong chip,

the A8, pricing it at $600 on average, 3 times more than the level of the last 6 years but in line

with what its closest competitors charged and with what its targeted customers were willing to pay

for. Because of the risk of customer rejection of the new iPhone's price hike, it developed a new 2-pronged strategy. On the one hand, in order to maintain its lead over its competitors, it would

increase the transistor count of its chips by a billion transistors every year (the latest A14 Bionic

chip on its iPhone 12 has 11.5 billion transitors). On the other hand, in order to increase unit sales,

it would execute a much more agressive "sales push" strategy in its then 400 Apple stores, with the

objective of generating more purchases from its 350 million annual store visitors. Today, in 2021,

Apple has 500 million visitors visiting annually its 500 Apple stores. The number of iPhones

sold annually has increased from 150M units to 220M units. As the market continues to shift

to subscription services, Apple has been forced to change the revenue model of its online service businesses, from a transactional to a subscription model (see point 15 below)

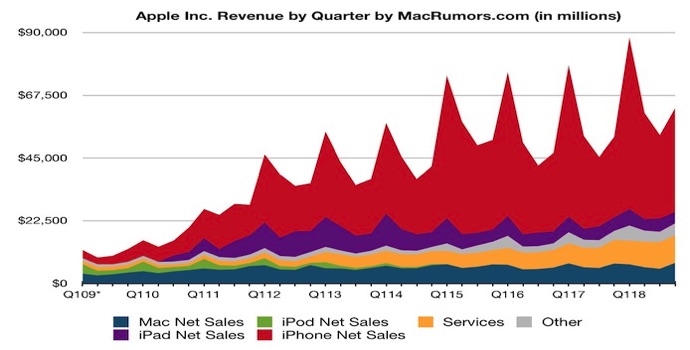

The Sales Objective Apple is confident it will reach its objective to increase overall revenue by 2022. End 2020, it introduced an entirely revamped line of its devices, enhanced by the latest AR/VR and 5G technologies (the iPhone 12, iPad Air, Apple Watch 6, Mac M1). In Services, Apple is positioning itself for the revolution that is taking place in the trillion dollar Media & Entertainment (M&E) industry. Leveraging their unique competitive advantage in video streaming technology, new entrants now hold 25% of the TV market. In this context, Apple is betting on its recently launched Media Bundle platform to generate the $20B to $25B of incremental revenue in Services it will need by 2022. This said, as shown on its FY 2020 10-K, Apple's "legacy" businesses will continue to thrive well into 2022: in developer and 3rd-Party apps on its online stores, its in-device apps (Maps, iCloud, AppleCare). Its $9B Google Search Referral business and its own $2B Search Ad business on its App Store are growing at double digit rates

3 The Financing

In the iPod, the iTunes store and its Macs, Apple had the cash flow to finance the development of

the iPhone, which by 2011, 4 years after its introduction, accounted for half of Apple's revenue

12 The Growth Machine

The Target Market Apple has targeted what it calls "Apps & Services" as its next major source

of growth, which is forecast to generate $72B of annual revenue by 2022 or twice its 2019 level

(last twelve months or LTM). For each dollar of revenue it would generate from its Apps and

Services business, Apple is expected to generate an additional dollar of revenue from its iPhone.

For the iPhone, with its 90%+ penetration rate in the business market, would be used as the traffic builder to sell its new apps and services market offering

Putting the best people in charge As shown on the org chart above, to drive what is really a

dual-track growth, Apple has put two of its ablest executives in charge: Eddy Cue and Susan

Prescott, respectively to run the consumer business and the enterprise business. Both can rely on

3 highly experienced sales & marketing executives in Tim Cook, the CEO, Phil Schiller in

marketing and Angela Ahrendts and her successor Deidre O'Brien in consumer and retail sales

The Consumer and Professional Markets In the consumer market, the major drivers are subscription-based applications (Netflix, HBO Now, Tinder, Spotify, Pandora) for adults and

games (Honor of Kings, Monster Strike,...) for a younger audience. In the professional market,

the App store has also garnered some 20 million developers, who have sold since its creation in

2008 some $100 billion of cumulative revenue

The Business Market In the business market, Apple has partnered with the major IT companies

in order to crack into the Fortune 500 market. Among the most talked about partnerships are the following: Salesforce.com in CRM and sales, Cisco in networking, IBM in big data, Accenture and Deloitte in digital transformation, SAP in ERP, GE in Industrial IoT. The flowchart below shows

that Apple will act as the Mobile provider and its partners as the Cloud, Data Analytics and

Network providers. Both are engaged in the latest AI technologies

8 The Ideal Product

Apple succeeded in designing what marketers call the "ideal product" which neither its

customers nor its competitors thought possible to make, that is 15 years ago. Here too, as the

attached article will show, it took them 4 years before they came up with the final design of

the iPhone in 2007

11 Customer Trust

As a business, the question one should perhaps ask following the Facebook-Cambridge Analytica

scandal is why Facebook, a company so protective of the privacy of its users, was so reckless as to

suddenly take the risk of flaunting its most precious asset, the trust it won from its customers.

Whatever the reason was, it should never have let it happen. Trust, not the product, is what

makes customers buy and come back

10 The Threat of Substitutes

Of the 5 forces of Porter's model, it is perhaps the threat of substitutes coming from competitors,

incumbents and challengers alike, which is perhaps the most important. Apple's iTunes

transactional revenue model has struggled against newcomer Spotify's subscription model, even if

Apple Music, introduced recently to fight off Spotify, is gaining traction

15 The Business Model for the Digital TV and Payment Markets

In both trillion dollar markets which are Digital TV and Payment, Apple provides 4 key apps customers can easily download on their devices to watch Digital TV and to make mobile payments. Regarding TV, the free Apple TV app allows customers to subscribe on an online platform to both 3rd-party channels and its own Apple TV+ channel. Regarding mobile payments, the free Apple Pay app allows customers to make payments with 3rd-party credit cards and its own credit card, the Apple Card

Apple's TV Market Strategy (Apple TV and Apple TV+)

Apple's strategy is therefore aimed at the the broader TV market, comprised of the traditional TV market segment and of the new OTT market segment. It uses the Apple TV app to attract to its own newly revamped platform the billions of now digital TV viewers. It remains to be seen whether Apple will be able to offer a unique content offering, as Disney in animation, Netflix in binge TV shows, and newcomer Quibi in short-form mobile-only video streaming

Apple's Payment Market Strategy (Apple Pay + Apple Card)

As with its Apple TV and Apple TV+ dual offering, Apple will use Apple Pay to carry 3rd-party credit cards, such as Visa and Mastercard as well as the Apple Card. In both cases, Apple will earn both processing

fees on the 3rd-party credit cards and interest income on its Apple Card, on the sale not only of

3rd-party products but also of its own products (which Apple Card holders can buy in installments)

14 The Business Model for the OTT Streaming Market Segment

Apple's strength is as a distributor, not as a content provider. It is its distribution channel, the

Apple TV platform, whose app is free, that generates real revenue. Its foray into content, or more precisely into the OTT streaming market, with the Apple TV+, did not succeed as it had expected

Apple's Real Strength Is As A Device Maker and As a Distributor

Overlooked more often than we think, it is both generic customers, the end-customer and the distributor, who are the final judge of a product's value, not the company. Both base their decison to buy not on one criteria but on a weighted average of all of the four criteria represented by the 4 Ps. In Apple's case, compared to competing products, until 2011, the iPhone received the highest customer ranking on all of the 4 Ps: i) product (superior technology), ii) price (real value for money), iii) place (convenience and ease of use both online and offline), iv) promotion (simple and transparent communications). Because it was an exceptional innovator, Apple scored highest on each of the 4 Ps

Why Netflix Succeeded And Apple Failed As a COntent Provider

Both Facebook and Netflix excelled before everyone else at combining technology and content to create what is now called the customer experience. It was Facebook who was the first to understand the market's shift to Mobile, away from PCs. In 2012, by betting on mobile before everyone else and combining it with user-generated content, it succeeded in displacing the incumbents, most notably MySpace in the social media space. In media streaming, Netflix, founded by a Stanford-trained computer engineer (Reed Hastings), also foresaw, as far back as 1997, that the increased data speeds and bandwidths of the next generation network technology, 4 G, would usher in a new industry in mobile video streaming. However, it had to wait until 2013 to find the right content strategy to combine with its technology strategy, when its Head of Content (Ted Sarandos) realized that there existed a huge untapped pool of talented filmmakers from all over the world who could make better and cheaper movies than what the traditional movie studios had been making, and which could be watched by an even wider audience through its online streaming service. Today, it vets some 2000 movies and TV shows a year, and has become a movie studio in everything but name. Netflix's current business model has the following marketing mix of 4 Ps: i) product (original content), ii) price (subscription pricing), iii) place (Cloud platform accessible to billions of Internet users with a mobile app), iv) promotion (data analytics to help customers select content). For the first time, Apple became a market follower. It was only in November 2019 that it launched its Apple TV+ streaming service, to regain lost ground against Netflix (see point 15)

The 2 Opposing Growth Models

Technology companies can grow and acquire new customers in 2 ways. The first way is to find a distribution channel with an already large subscriber base. The iPhone really took off in 2007 largely thanks to Apple's partnership with AT&T. The second way is to have access to an unlimited financing pool to build up from scratch one's own large subscriber base. Here, we have Facebook which pulled it off and Uber which hasn't. Apple has the best of both worlds: a very large base of a billion users to tap into, and unlimited internally generated financing

TV, Cable TV Subscription

Apple TV+

Original Content

Apple News+

Apple Arcade

iTunes Store

Apple Podcasts

Apple Music

Cloud platforms

eCommerce

Social Media

OTT streaming Subscription

Search

13 The Business Model for the Chinese Market (International Strategy)

There is the strategy one needs to define for the company's activity. Then, there is the business model one needs to develop for each market one serves in order to execute that strategy.

To us, the best approach to business modeling is to develop the marketing mix's 4 Ps. With the help of digital technology, the goal is to create a unique customer experience....for that market

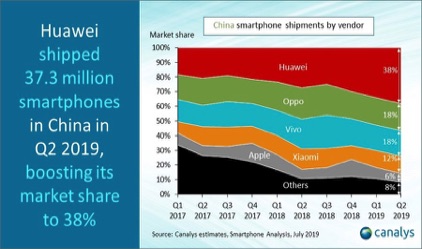

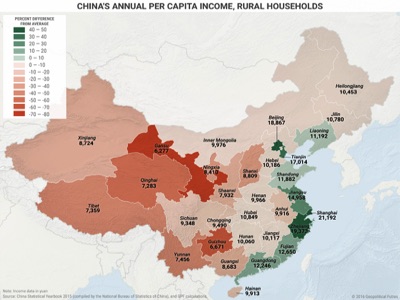

In the Chinese market, Apple has been losing market share. Chinese consumers have made a massive switch to products of slightly lower quality, for no other reason than to promote their local champions, Huawei, Xiaomi, Oppo. Of the 4 Ps, Apple has executed brilliantly on Product but stumbled on Price, Place and Promotion where the local players had the home court advantage. Just as Apple cleaned the slate in the US with its iPhone, the market disruptor in China was not Huawei but a rather discreet newcomer, Oppo. It pushed aside both its domestic and foreign rivals to gain the number one spot with 40% of the chinese market with its Oppo and Vivo brands. It followed a classic textbook strategy, by tapping into a vast market its competitors somehow shunned, the rural market (650M people). To service it, it aggressively built up what has become a retail network of 200,000 stores across the country. From this beach head, Oppo moved into the urban market (also 650M people), by upgrading its product offering to meet the needs of higher-income customers. In hindsight, whether Apple could have opened its Apple stores more agressively across China, in both the rural and urban areas in order to preempt the encroachment of Oppo on its own turf at the higher-end of the market remains a question mark. There are 2 other players not to be underestimated: Lenovo and Tecno

After a 2-year lull in sales in 2018 and 2019 hovering at $40B a year, Apple finally turned the

corner in Calendar Q4 2020, as it witnessed an increase of 57% in sales. Product: it is the new

iPhone 12, far superior to its rivals' smartphones, which is behind the success. Price, Promotion,

and Place: the biggest challenge for Apple is to ensure further growth of the high-end market

segment it is in, by luring customers from the mid- to lower-tier segments. Pricing, distribution partner markup and financing and new Apple Store openings will be key decisions it will unhesitatingly make

Internet Subscription

Mobilephone Subscription

5G Network

Subscription

OTT Streaming Competitors

Marketing

& Digital

Innovation

& Design

Operations

& Cloud

Strategy

& People

CEO Tim Cook COO Jeff Williams

(User Privacy, Business Development & Executive Development)

ESG

Big Data

Legal

Marketing

Finance

Sabih Khan

(Customer Value Delivery)

John Giannandrea

(Autonomous Driving?)

Strategy: Marketing Tech, AI, Data Analytics/Business Intelligence, Digital Costing, Decentralized Finance

Operations: Workflow (activity), RPA (transaction), Collaboration (teams), Universal Ledger (accounting)

Administration: eSignature/OCR, Document Classification Automation (ML), Speech to Text

Blockchain (direct tax & audit, smart contracts), Central Bank Digital Currency, ERP

Evans Hankey &

Alan Dye

Katherine Adams

David Smoley

(Analytics /BI & Applications

Strategy)

John Ternus

(Hardware Engineering)

Johny Srouji

(Hardware Technologies)

AI

Cloud & 5G

Corporate Development

Adrian Perica

Hardware Platform

AI Apps

Data Analytics,

Marketing tech

AI Apps

Network

Apps & Services

AI Apps

Smartphone

iOS

iPhone, Tablets,

Apple Watch

OTT Streaming

16 Price versus Value

Apple's stock reached an all-time high to about $56 per share on October 1, 2018. Overall end

Sep 2018 fiscal year sales reached $265B, an increase of 15% over the previous year, with operating

income increasing by the same percentage. As both graphs of Apple and Netflix below show, in

spite of stellar results, technology stocks plunged somewhat unexplicably by 30% to 40% in Q4 2018,

only to regain the following quarter 80% of its peak Q3 2018 value. Thus, Apple did the right thing by choosing not to be distracted by the 3-month speculative window capital markets like to play in, as in Q4, 2018. It preferred to focus on the long-term fundamentals of the business. No better metric than its annual spending in R&D over a 3-year strategic horizon reflects this commitment, which increased from $8B in 2015, to $10B-$11.5B in 2016/17, to $14.2B in 2018, to $18.8B in 2020. As of end April 2021, Apple's stock price hit $132 per share, a 4-fold increase compared to its 2015 price

(both Apple share prices are on a 4-for-1 stock split basis of Aug 2020)

Apple's cross-selling strategy: Apple TV, Apple TV+

Business Activity

Business Strategy

Business Model

Marketing Mix (4 Ps)

Customer Experience

FANGs

(Facebbok, Amazon, Netflix, Google,...)

MSOs

(Comcast, AT&T, Disney)

Mary Demby, CIO

(Digital Infrastructure)

David Smoley

(Digital Transformation)

Umashankar Thyagarajan

(Internet Network, 5G)

Greg "Joz" Joswiak

Bob Borchers, Product

6 The Positioning

Apple's recent problems in China, which it has corrected, go to show that positioning one's

offering in the marketplace involves both a product as well as a price positioning, relative to

both its customers and its competitors:

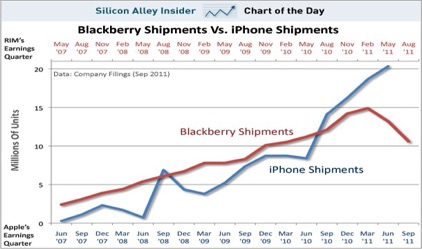

Product Positioning Playing on its unique strength as a developer of high quality products, Apple

deliberately chose to position itself at the higher-end of the market. It took Apple no less than

4 painstaking years to develop the iPhone and another 5 years to push Blackberry out of the

market. As Alfred Sloan would have said, the strategy was to sell to those Blackberry customers

in the lower-end segment willing to pay a little more for the additional quality offered by

Apple in the higher-end segment

Price Positioning The worst decision a firm can make is to price its offering out of the market,

above the customer perceived price, in other words to price the offer above what its customers

think it is really worth. This overpricing may explain what happened with the iPhone in China,

where Apple witnessed from 2016 to 2019 a continued decline in both sales and market share. In September 2019, it finally reduced the price of its entry model iPhone XR and iPhone 11 to $600 as well as offered a further $100 to $200 trade-in discount for older models and Android phones and possibly increased channel partner margins. Radically revamping this pricing policy alone was not enough to reverse the decline in sales. It was only by also substantially enhancing the quality of the iPhone 12, its customer perceived value, that its sales grew again and at double digit rates.

An applicable formula is value - price = profit as perceived by the customer. In other words, the

term value-for-money is applicable as much to the higher end of the market Apple is in as

it is to the lower end where it is generally used

Absolute Growth vs Relative Growth As shown below, Blackberry's sustained growth 5 years running from 2007 to 2011 may have blindsided them from seeing the even stronger growth of the iPhone. Its sales began to plunge in Q1 2011. Two years later, it filed for bankruptcy

SVOD*

Apple TV App

3rd party Content

Apple Pay

Apple Card

Apple Wallet

App Store

Apps

iCloud

Maps

AppleCare

Other Services

Products

iPhone

Macs

iPads

Apple Watch

Airpods & Accessories

Apple's Cross-Selling Strategy: OTT, ALL Other Products

APPLE

(Products and Services)

Netflix

Apple

Apple TV App

Digital TV

Apple Podcasts, Apple Books

Licensing

(i.e. Google)

Siri & AI

in-device

Maps

in-device

Apple Care

in-device

App Store, Apple Search Ads

Apple TV 4K,

Siri Remote

Homepod, Homepod Mini,

Smart HomeKit

Beats Wireless Headphones (1)

Airpods (1)

Apple Watch series 7 & Bands (1)

Macbook Pro with M1 Max chip 2021

iPad 2021

iPhone 13 2021

APPLE'S

ORG CHART

TVOD*

* SVOD: subscription video on demand, TVOD pay-per-view transactional video on demand, AVOD: advertising-based video on demand

AVOD*

Operations

Products

Services

developer.apple

mfi.apple (IoT)

Wearables, Home & Accessories

Apple's cross-selling strategy: Apple Pay, Apple Card, Promotional Pricing

Apple's Cross-Selling Strategy: Indirect Channel Partners

Apple Direct

Retail

Channels

Apple Direct

Sales Force

Apple Indirect

Wholesalers

Apple Indirect

Retailers

Apple Indirect

Enterprise Partnerships

Markets

Consumer,

Business

(Industrial, Commercial)

Government,

Community,

Non-Profit

Developer

CHINA'S URBAN MARKET

CHINA'S RURAL MARKET

Apple 4 Ps: Place

Huawei P20

Product:

40 MP main sensor,

20 MP secondary sensor,

8 MP telephoto sensor

Price:

<$500

Market Share:

38%

Oppo R17

Product:

20 MP main sensor

12 MP secondary sensor

3D stereo sensor

Price:

<$500

Market Share:

36%

Xiaomi Mi CC9

Product:

27 MP main sensor

20 MP secondary sensor

2-lense telephoto sensor

Price:

<$500

Market Share:

12%

iPhone 12

Product:

AI Optical Stabilization

for Cameras and Front Camera (Night Mode)

5G, Ceramic Shield and MagSafe, A14 Bionic

Price:

$799, entry model at $399 for iPhone SE, $200 trade-in

Market Share:

6%

Apple's China Sales Witnessed a 57% Increase in Sales in Q4 2020

Relative Growth: How can Apple reverse course in China?

2007-2013 Apple elbows out Blackberry

2017-2019 Apple is overtaken by Huawei

Digital TV (traditional TV + OTT Streaming)

Home Assistants

Operating Systems

Netflix and Quibi have refused to be distributed by Apple

Pure Play

free Apple TV app and Airplay chromecasting software

to lure to its subscription services, such as Apple TV+

(1) Apple's New Accessories Strategy: Downstream, Apple's ACCESSORIES (Beats headphones, Airpods, the $5000 Pro Display, $1000 Pro Stand, the iPad Pro's $300 Magic Keyboard and $129 Pencil, the $30-$150 MagSafe USB-C chargers, the Airplay, the Homepod and HomeKit, the $500 Hermés Watch wristband,..) have become a standalone high growth and highly profitable multi-billion dollar business SBU. Apple also takes a cut on all 3rd-party accessories. Upstream, it also has 2 SERVICE REPAIR programs to sell its parts (independent and self-service)

Health & Fitness

Platform

Healthcare

Platform?

Apple Watch

(Apple Glasses?)

Apple's Cross-Selling Strategy: Apple Watch & Verticals

Airplay

Co-Branding

(Hermes, Nike, Edition)

Other

Luxury Markets?

Current

Future

Media Bundle

(September 2020)

Fintech Bundle

(contactless,

credit card loans,

buy-now-pay-later, trade-in)

Trade-in

Instalment

Promotional Pricing

DEVTECH & ANALYTICS

Content, Campaign

(DAM, CMS, MRM)

Developer & Design Platforms

(DevOps, 3D CAD)

OPSTECH & ANALYTICS

Glocal Manufacturing/Supply Chain Coordination,

eCommerce Logistics, Predcitive and Prescriptive Analytics

BIZTECH & ANALYTICS

(Agile, Team, Skills, Data Analytics/BI, ERP)

Tor Myhren

Nick Law

Martech & Advertising

Sales & Channels

Retail

Deidre O'Brien

Application Development

Eddy Cue

(In-Device Apps & Online Services)

Business Development

Market Development

Isabel Ge Mahe

(Greater China)

Susan Prescott

(Enterprise Market)

Business Fundamentals

Luca Maestri

(CFO)

Gary Wipfler (Treasurer)

Saori Casey (Controller)

HR

Deidre O'Brien

Joel Podolny (Apple U)

Manager's Digital Toolkit

MARTECH & ANALYTICS

Connection (Search, Social, Advertising, Omnichannel),

Interaction (Experience, CRM, Personalization, Leads)

Acquisition (eCommerce, CS)

Craig Federighi

Software Platform

Tim Cook

Direct Sales, Channels & Partnerships

Product

Development

Jeff Williams

(Customer Value Proposition & Profitability)

Face ID 30000 dot face map

TrueDepth Camera System

LIDAR Scanner for AR apps

Design & User Interface

AI Visual Recognition

AI Chip

Apple Watch S6 chip

5G chips from Qualcomm

True Depth camera system

Face ID sofware

LiDAR Scanner with Augmented Reality (AR)

iPhone and iPad A14 chip

Macs M1 chip

Security chip

U1 Chip (right) the chip uses Ultra-wideband (UWB) technology which allows for close range (1cm) localization and high penetration radar, at low-power. Medical monitoring is a future application (UWB can read through the human body). 5G Chip (left) Apple acquired Intel's 5G Modem Chip business (to replace Qualcomm's or to develop 6G?)

Supply Chain

175 suppliers, 25 SKUs, Distr. & Data Centers

Manufacturing

Strategic parts in TW, JP, SK, US, GER

(Renesas, TSMC,..)

Assembly in

CN, IN, VN

(Foxconn/Petragon TW)

Marketing Channels (% sales)

Carriers 35%, Amazon 15%

Whole/Retail 10%

Apple Stores 10%

Online Stores 25%

(App store, Apple.com,...)

Direct Sales 5%

% Gross Margin

US/ Europe 30%/32%

China/Japan 37%/42%

Airpods H1 chip

Online Stores: Apple.com

App Store

Apple One

and dedicated sites (search ads,...)

Security & Privacy

(right) the security hardware (T2 Chip) and the Privacy software protect users from device and app tracking (Safari, Maps, App Store,....)

Touch Screen & Printed Electronics

There are 3 thin films sprinkled by evaporation with conductive materials (metal): the Touch panel , OLED display and Sensor chip that connects to the Operating System. They are glued or "laminated" with an adhesive called OCA. On top is the Gorilla Glass

Apple: prior to its 4-for-1 stock split on August 28, 2020

Advanced Manufacturing FUnd

IoT U1 chip

IoT

mfi.apple.com

Eddy Cue

(Apps & Services)

(Media Bundle, Digital Payment & Fintech,

Apple Search Ads, User Apps, App Store)

BNPL

Apple Card

Apple Cash

Apple Pay

Apple completes its Fintech offering with its recent acquisition of Mobeewave, a Buy Now Pay Later (BNPL) provider. Throught its Apple Wallet app, it now has the following lineup:

. Credit (Apple Card and Mobeewave)

. Money Transfer (Apple Cash)

. Mobile Payment (Apple Pay)

Lisa Jackson

Communcations

Stella Low

Digital Transformation

to sell offline

to sell apps online

to sell music online

to sell the phone

The Right Channel

The Right Market

The Right Product

from Insight

to Business Opportunity

to Marketing Strategy

Iteration

Iteration

To claw back to its 22% of market share in China in Q3 2021, Apple had i) to come up with a far superior product (the iPhone 12),

ii) to overhaul its marketing strategy (4 Ps) and its competitive strategy (5 Forces), specifically for the Chinese market. See point 13

Or Man Partners